Find User-Friendly Banking Apps

In today’s fast-paced world, having a user-friendly banking app can make managing your finances more convenient and efficient. The best banking apps offer intuitive interfaces, robust security features, and a wide range of functionalities that allow you to handle transactions, monitor account activity, and plan your financial future with ease.

1USAA Mobile

0 votes

The USAA Mobile app is designed specifically for members of the military community and their families, offering a range of features to manage finances conveniently. The app provides a user-friendly interface that allows users to check account balances, transfer money, pay bills, and deposit checks easily. USAA Mobile also includes financial management tools such as spending analysis, budgeting assistance, and goal setting. One of the standout features is the app’s robust security measures, which include biometric login, two-factor authentication, and real-time alerts for suspicious activity. The app also supports mobile payments and integrates with digital wallets like Apple Pay and Google Pay. USAA Mobile offers insurance and investment services, allowing users to manage all their financial needs from a single platform. With its comprehensive features, security, and user-friendly design, USAA Mobile is an excellent choice for military members and their families looking to manage their finances efficiently.

0

Do you agree? 0% of people agree with your point of view!

2Ally Mobile

0 votes

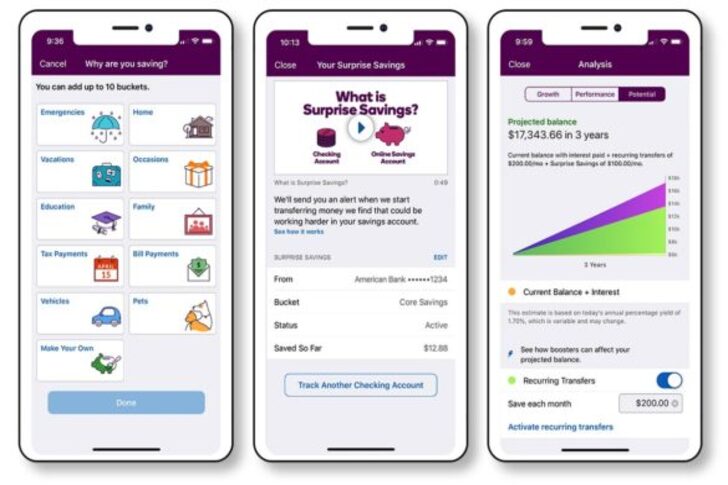

Ally Mobile offers a seamless banking experience with its user-friendly design and wide range of features. This app allows users to manage their Ally Bank accounts, including checking, savings, and investment accounts, from one convenient platform. The app’s interface is clean and easy to navigate, making tasks such as transferring money, paying bills, and depositing checks simple and efficient. Ally Mobile includes useful budgeting and spending analysis tools that help users track their expenses and manage their finances better. The app also provides competitive interest rates on savings accounts and CDs, and it offers a variety of investment options through Ally Invest. Security is a top priority, with features like two-factor authentication, biometric login, and real-time alerts for suspicious activity. With its no-fee structure, high-interest savings options, and comprehensive financial management tools, Ally Mobile is an excellent choice for those looking to streamline their banking and investment activities.

0

Do you agree? 0% of people agree with your point of view!

3Capital One Mobile

0 votes

Capital One Mobile is a robust banking app that offers a wide range of features designed to make banking easier and more convenient. The app’s clean and intuitive interface allows users to manage multiple accounts, view transaction histories, and make payments effortlessly. Capital One Mobile includes several innovative tools such as CreditWise, which provides free credit score monitoring and tips to improve credit health. Users can also set up customized alerts for transactions, payments, and due dates to stay on top of their finances. The app supports Zelle for quick and easy person-to-person payments, and it offers comprehensive security features including biometric login, real-time fraud alerts, and the ability to lock and unlock cards instantly. With its seamless integration of banking, credit monitoring, and spending management tools, Capital One Mobile is a top choice for users seeking a comprehensive and user-friendly banking app.

0

Do you agree? 0% of people agree with your point of view!

4Wells Fargo Mobile

0 votes

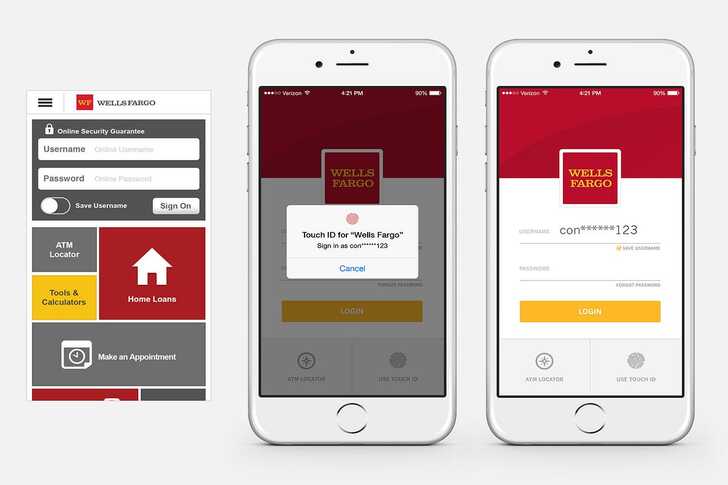

The Wells Fargo Mobile app offers a comprehensive suite of features designed to simplify banking and financial management. The app’s user-friendly interface allows users to check account balances, transfer funds, pay bills, and deposit checks with ease. Wells Fargo Mobile also includes features such as My Spending Report, which provides a detailed overview of your spending habits and helps you manage your budget more effectively. The app supports Zelle for quick and secure money transfers and provides personalized alerts to keep you informed about your account activity. Security is a top priority, with features like two-factor authentication, biometric login, and real-time fraud monitoring. The app also integrates with Wells Fargo’s financial planning tools, allowing users to set savings goals and track their progress. With its wide range of features and intuitive design, the Wells Fargo Mobile app is a solid choice for anyone looking to manage their finances conveniently from their mobile device.

0

Do you agree? 0% of people agree with your point of view!

5Bank of America Mobile Banking

0 votes

The Bank of America Mobile Banking app is a feature-rich platform that caters to a wide range of banking needs. The app offers an intuitive interface that allows users to manage their accounts, pay bills, transfer money, and deposit checks with ease. One of its standout features is Erica, the virtual financial assistant, which provides personalized insights, alerts, and assistance with everyday banking tasks. The app also integrates with Zelle for fast and secure person-to-person payments. Users can set up custom alerts for transactions, low balances, and due dates to stay on top of their finances. Bank of America’s security features include fingerprint login, Face ID, and real-time fraud monitoring. The app also provides access to budgeting and spending tools, helping users track their financial health. With its comprehensive features and user-friendly design, the Bank of America Mobile Banking app is a reliable choice for managing your finances on the go.

0

Do you agree? 0% of people agree with your point of view!

6Chime

0 votes

Chime is a mobile-first banking app designed to make financial management straightforward and accessible. The app offers a user-friendly interface that simplifies banking tasks such as checking account balances, transferring money, and setting up direct deposits. One of Chime’s standout features is its early direct deposit, allowing users to receive their paychecks up to two days earlier than traditional banks. Chime also provides fee-free overdraft protection up to $200, which is a significant benefit for many users. The app includes automatic savings features, enabling users to round up transactions to the nearest dollar and save the difference or set a percentage of direct deposits to be transferred into a savings account. Chime’s security features include real-time transaction alerts, instant card blocking, and biometric authentication. With no monthly fees, minimum balance requirements, or foreign transaction fees, Chime is an excellent choice for those seeking a straightforward, fee-free banking experience.

0

Do you agree? 0% of people agree with your point of view!

Recent Comments